The Billion Dollar Bytes brought to you by Beyond The Billion, powered by Mastercard is a virtual series focused on fueling women-led innovation.

The phrase is getting old, but the reality remains: we face an unprecedented time with the impact of the pandemic continuing to unfold.

Even pre-crisis, the gender venture investment gap was worrying: hardly surpassing 3% in 2019 of global venture funding to all-women teams, and 10% to gender-diverse teams. Why do we care? The venture-backed technology industry is already a key driver of the innovation economy in the U.S.: 43% of U.S. public companies, comprising 57% of the market capitalization, are VC-backed—what does this mean if we exclude women? What does this mean in a time of crisis?

Too much of our world was designed without women in mind –and without women involved. Even today, inequality and exclusion still hold women back. That’s why Beyond The Billion and Mastercard are pushing our networks further, forging ambitious partnerships and championing the people, businesses, and innovations that are transforming the way our world works.

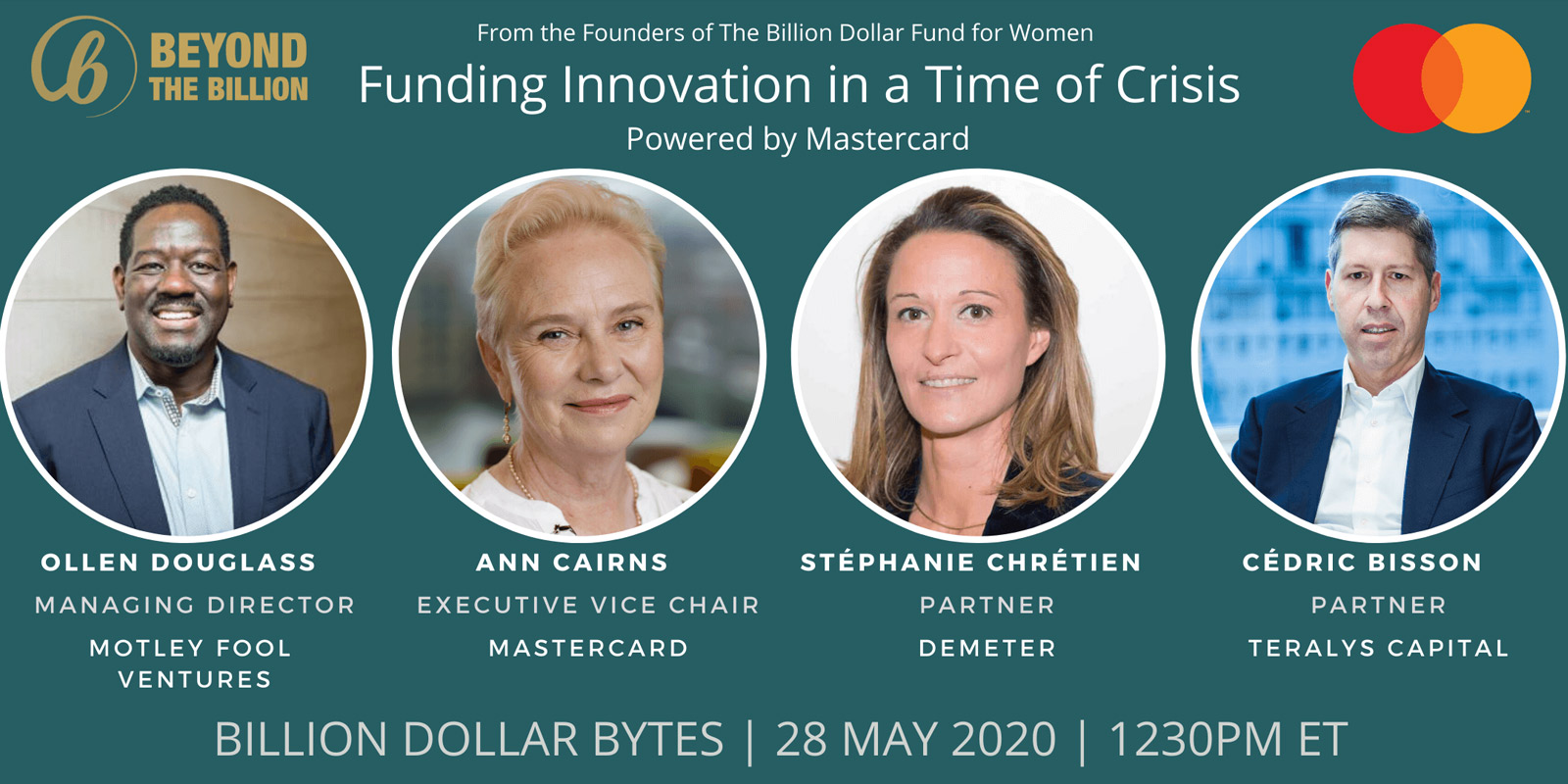

#BYTE 1: Funding Innovation in a Time of Crisis

- What does the new normal look like from the lens of funding innovation?

- What will the “shake-out” mean for the venture community?

- How are we thinking about inclusive growth through venture?

Read our recent recap here

Speakers:

Ann Cairns, Executive Vice Chairman, Mastercard

In her role as vice chairman, Ann represents Mastercard around the world, focusing on inclusion, diversity and innovation. She plays the important role of senior ambassador and executive leader with a global remit and serves on the company’s management committee. Prior to her appointment, Ann was president of International Markets responsible for the management of all customer-related activities in over 200 countries around the world. Prior to joining Mastercard in August 2011, Ann was head of the Financial Services Group with Alvarez & Marsal in London, where she led the European team managing Lehman Brothers Holdings International through the Chapter 11 process. In addition she helped restructure banks across Europe including Ireland & Iceland. Ann has also held senior positions within many global organizations including a tenure as CEO, Transaction Banking at ABN-AMRO, and 15 years in senior operational positions at Citigroup.

Ollen Douglass, Managing Director, Motley Fool Ventures

Ollen leads Motley Fool Ventures, a $150 million venture fund that invests in early-stage companies leveraging technology to create a clear competitive advantage in their industry. Prior to joining the Fund, Ollen was CFO of The Motley Fool Holdings, Inc. for 14 years. During that time, he was responsible for the overall financial health of the Fool, and helped guide the company through periods of major growth, contraction and market volatility.

Cédric Bisson, Partner, Teralys Capital

Cédric is a partner at Teralys Capital, Canada’s largest technology fund of funds management organization with over $2Bn AUM, where he focuses on healthcare and life sciences investments. Previously, Cedric headed the healthcare activities at iNovia Capital where he focused on building and investing in clinically meaningful opportunities in biopharmaceuticals, medical devices and related areas. Prior to that, he was associate principal at McKinsey & Company, a large international management consulting firm.

Stéphanie Chretien, Partner, Demeter

Stéphanie is partner at Demeter, a Paris- based major player in venture capital and private equity for ecological transition. They invest from €1m to €30m to support companies at all stages of their development: innovative startups, high growth SMEs and infrastructure projects. Stéphanie has over 18 years of experience in digital, innovation, venture capital and startups support and is dedicated to Paris Green Fund as a Partner.

THIS EPISODE WAS PROUDLY POWERED BY MASTERCARD:

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart, and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments, and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.