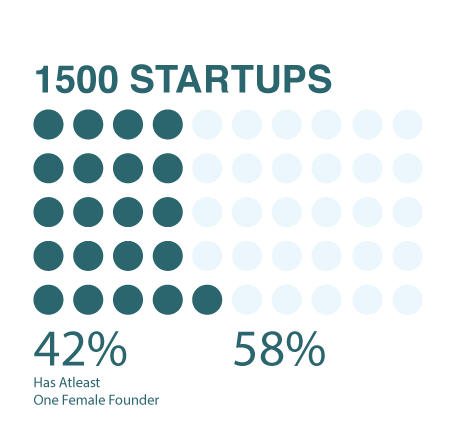

A SYSTEMIC GAME CHANGER- FUELING WOMEN FOUNDERS AND FUNDERS THAT INVEST IN THEM

DECA BILLION +

Anchored by an accountability platform, DECA-BILLION+ cracks the fund manager/investor code scaling capital commitments for innovation by women of all races.